Filing a nil return is easy, and you should not pay a fine for failing to do it. Keep reading to find out how to file nil returns on iTax KRA.

iTax Account and Nil Return Qualification

To file a nil return, you, of course, need a KRA pin and an iTax account. But before you find out how to file a nil return, you should ask yourself, are you qualified to file it in the first place?

You should file a nil return if you are unemployed or are a student. However, if you have earned an income, no matter how little, you should file tax returns unless your income falls below the taxable income bracket. Therefore, you should only file a nil return when you have not earned any income at all for twelve months.

To avoid paying penalties for failing to file tax returns, Kenyans have, in the past, opted to file nil returns. In turn, KRA last year suspended the filing of nil returns to weed out tax cheats.

Currently, KRA is conducting a tax return audit to assess which taxpayers filed returns that do not reflect their income.

How to File a Nil Return on iTax KRA

If you are qualified to file a nil return, you should go ahead and follow these steps.

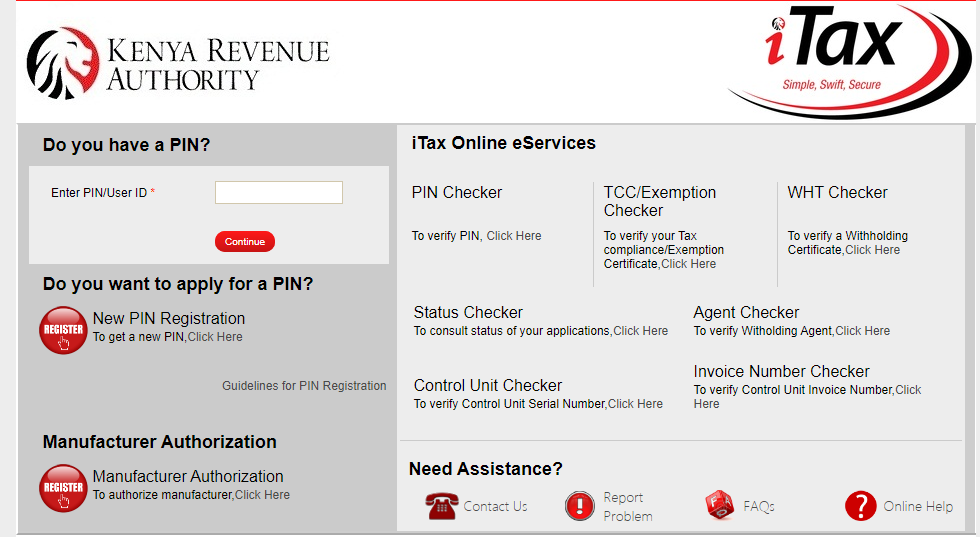

- Visit the Kenya Revenue Authority portal

- If you have an account, enter your PIN. If you do not have an account, create one.

- Click “Continue” and input your password. If you have forgotten your iTax login password, simply reset it by clicking “Forgot Password”

- Answer the security stamp question and click “Log In”

- A prompt will ask you to update your professional details. Once you submit, click the “Returns” tab on the iTax portal and choose “File Nil Return” from the dropdown menu

- Three fields will appear. On the “Type” field, select “Self.” Enter your PIN in the “Taxpayer PIN” field, and select “Income Tax-Resident Individual” under the “Tax Obligation” field

- Click “Next” and enter the return period from and to in the fields provided. The tax period is twelve months

- Click “Submit” and download the return acknowledgement receipt and you are done

Filing a nil tax return is that simple. The last tax return deadline was last month, June 30. If you file your individual income tax return beyond the deadline, you could pay a fine of Sh2,000.

Applying for a Tax Compliance Certificate

After filing a tax return, you should consider applying for a tax compliance certificate. You can use this as proof that you are tax compliant when opening a bank account or when looking for a job.

To apply for a tax compliance certificate, take the steps below.

- Visit the iTax portal

- Enter your PIN

- Click “Continue”

- Type in your password and answer the security stamp question

- Hit “Log In”

- A pop-up will appear asking you to update your profession. Do that and click “Submit”

- Go to the “Certificates” tab and select “Apply for Tax Compliance Certificate”

- Input your PIN, your name, and the reason for the application

- Hit “Submit”

- Download the acknowledgement receipt for a Tax Compliance Certificate.

KRA will send you an email, either approving or rejecting your application in about five business days. If the Authority approves your application, you will receive the certificate in PDF format, which you can download and print. Tax Compliance Certificates are only valid for twelve months.