If you have heard about bitcoin but have not bought some yet, here’s an article that might make you rethink that. You will learn why you should probably own bitcoin and where you can buy it.

What is Bitcoin?

Bitcoin (BTC) is a cryptocurrency that pseudonymous developer(s), Satoshi Nakamoto, launched in January 2009. The digital currency enables users to send payments on the peer-to-peer Bitcoin network without going through financial institutions that act as third parties.

The network comprises a collection of nodes that verify transactions using cryptography and record them on a blockchain. The Bitcoin blockchain technology provides immutability, transparency, and decentralisation.

Bitcoin was the first-ever cryptocurrency. Before that, several forms of electronic cash had been invented, but none were successful. For instance, Nick Szabo proposed Bit gold in 1998, a decentralised digital currency that used the same proof-of-work system like Bitcoin. In the same year, Wei Dai proposed an anonymous distributed electronic cash system known as B-money.

Bitcoin has a limited supply of 21 million, which means its value will increase as scarcity rises. Additionally, it has several sub-units, with the smallest unit representing one hundred millionths of a bitcoin (0.00000001BTC), known as Satoshi.

That means that you do not have to own a full bitcoin, which is expensive at its current price of more than $10,000.

Why Should Everyone Own At Least Some Bitcoin?

Now, let’s take a look why everyone should (probably) own some bitcoin.

Bitcoin As a Safety Net

To own bitcoin is to have financial sovereignty. No one can prevent you from owning or using it. Bitcoin is a censorship-resistant store of value that is poised to increase in value as it becomes scarcer.

Bitcoin’s price has risen tremendously in just the last 16 years, and the stage is set for this trend to continue. Therefore, if you buy and hold bitcoin today, it could be worth a lot more after a few years.

Alternatively, you can make use of the price fluctuations to buy low and then sell high for a profit. Many Africans are turning to bitcoin trading as a source of revenue during tough economic times. Moreover, high unemployment rates could be driving Africans to crypto trading.

Bitcoin is also a hedge against weakening currencies and a struggling global economy. For example, fiat devaluation and instability are forcing Africans to turn to cryptocurrencies.

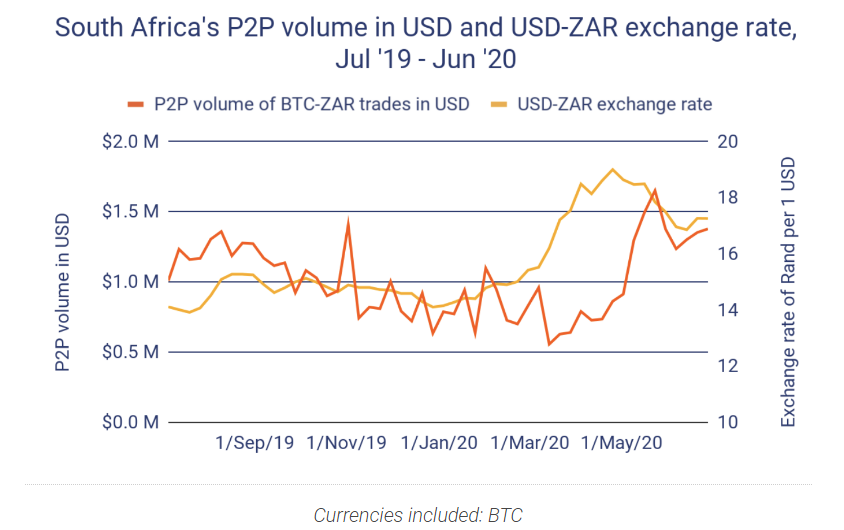

A recent report from Chainalysis shows that when a fiat currency loses value, P2P bitcoin trade volumes increase.

“Cryptocurrency can act as a more stable value store for people living [in countries with currency devaluation and instability],” Chainalysis wrote in its report.

But There Are More Reasons to Own Bitcoin!

Bitcoin transactions are pseudonymous. That means there is no link between the transactions and the real-world identities of the people that make them. However, bitcoin addresses are recorded, and law enforcement agencies can use them to catch criminals. That means that the good guys will enjoy near-private transactions, while the bad guys will be risking using bitcoin to conduct illegal dealings.

While on the topic of bitcoin transactions, you can make them 24/7. There are no business hours, weekends, or holidays in the bitcoin world. That beats traditional financial institutions 10-0! Full financial control is crucial, and thanks to bitcoin, anyone can experience it.

Furthermore, you can use bitcoin to pay for services and products from anywhere in the world. High costs, slow speeds, and lack of transparency with regard to exchange rates are some of the challenges that affect cross-border payments. Bitcoin streamlines these payments by eliminating the middleman, for instance, hence reducing the overall costs. As a result, you can use bitcoin to pay someone living on another continent, and they will receive it in minutes.

Also, bitcoin comes in handy when you do not have enough fiat money to make a transaction or when you cannot access the funds in your bank fast enough for large transactions.

Lastly, bitcoin offers you an opportunity to diversify your investment portfolio. Since BTC usually has a low correlation with traditional investment assets, you can use it to manage your portfolio’s risk.

How to Buy Bitcoin in Africa

Ideally, you shouldn’t just buy bitcoin with investment in mind. You should also buy bitcoin to understand how it works because it is the best way to understand wallets, bitcoin addresses, private keys, seed key phrases, and mining fees.

That said, here is how you can buy bitcoin in Africa:

- Acquire a bitcoin wallet. To do this, download and install a wallet on your smartphone that supports multiple cryptocurrencies. Examples of such wallets include Jaxx, Exodus, and Mycelium. Also, you can buy the more secure hardware wallets like Ledger Nano S.

- Next, create an account on a peer-to-peer marketplace like LocalBitcoins or an exchange like Luno. Note that most crypto platforms will ask you to verify your phone number, home address, and identity. To verify your identity, platforms will ask you to upload your identification card and to take a selfie holding it. Users get a wallet automatically after they register on a crypto platform.

- Once you have met all the KYC requirements, you can now buy bitcoin. On a P2P marketplace, you will buy bitcoin from other traders. On the other hand, if you are using an exchange like Luno, you will buy directly from the platform. Depending on the platform you are using, click “Buy” and enter the amount of money you are willing to spend.

- Subsequently, follow the prompts and make the payment. If you want a diverse option of payment methods, use a P2P marketplace.

- After your transaction is complete, you will receive bitcoin in your platform wallet.

- Transfer the bitcoin from the platform’s wallet to the mobile wallet you created in the first step.

Bitcoin is a censorship-resistant, one-of-a-kind asset that allows you to store money that you have full control over. Even if your bank decides to freeze or bail in your funds, you will still be able to access your bitcoin. In a time of increased financial uncertainty, owning at least some bitcoin could become a lifesaver.

To read more about currencies, check out the top ten largest currencies in Africa.