The Bitcoin DeFi space is growing fast—and Liquidium is right at the center of it. Built to bring utility to Bitcoin-native assets like Ordinals and Runes, Liquidium is a lending protocol that lets users borrow or earn yield in BTC using these digital collectibles as collateral.

With the launch of Runes on Bitcoin in April 2024, a new class of fungible tokens has emerged on the Bitcoin base layer. These tokens are simple, efficient, and compatible with Bitcoin’s UTXO model—unlike BRC-20s, which came before them. And now, thanks to Liquidium, Runes holders can put their tokens to work and earn a return in real bitcoin (BTC).

Read on to learn how it works and how you can earn up to 380% APY on your BTC.

Here’s How Runes Lending Works!

On Liquidium, holders of high-value Runes tokens can lock up their assets as collateral and take out loans in Bitcoin.

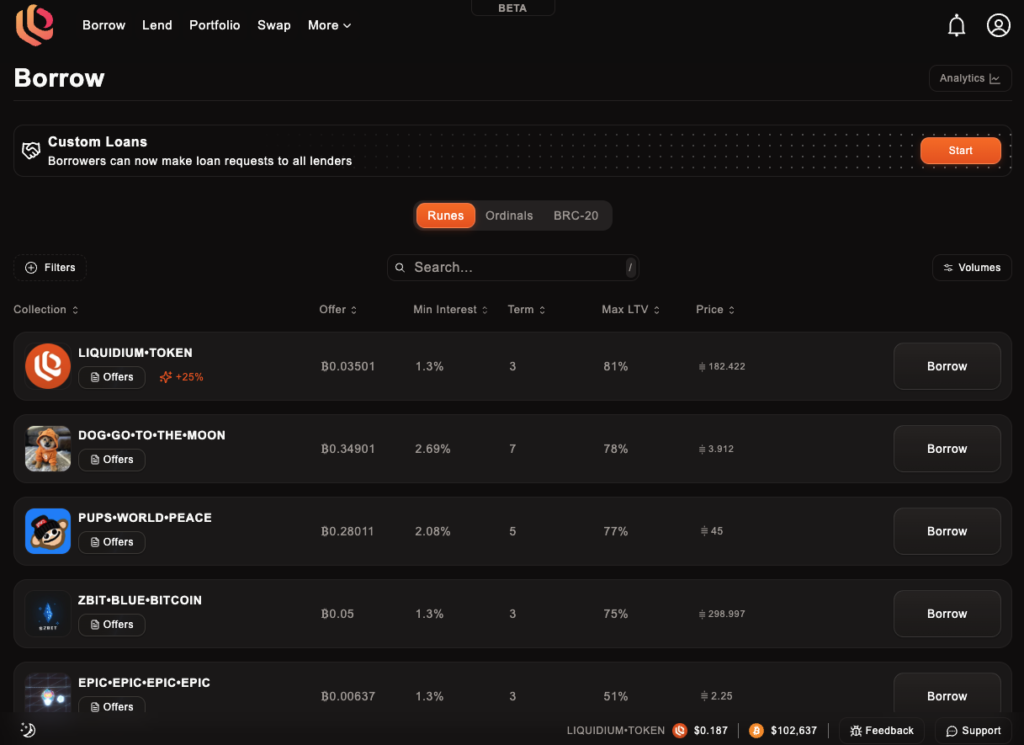

The protocol operates through an open, peer-to-peer model where lenders offer BTC and set their own terms—like the interest rate and duration—while borrowers propose collateral in the form of Runes.

If both sides agree, the loan is executed trustlessly via smart contracts. The borrower receives BTC, while the Runes token stays locked until repayment. If the borrower fails to repay on time, the lender gets to keep the Runes collateral.

It’s win-win: borrowers unlock liquidity without selling their assets, and lenders earn yield in sound money—bitcoin.

Why Use Runes for Lending?

Runes tokens have already shown strong demand in the market.

Popular mints like DOG•GO•TO•THE•MOON and RSIC have seen massive trading volume on marketplaces like Magic Eden. These top-tier Runes have value, and Liquidium gives their holders a way to leverage that value without dumping their bags.

If you’re bullish on Runes long-term but want to earn or access BTC today, Liquidium provides that bridge.

Exciting Yield Opportunities for Bitcoin Lenders

As a lender on Liquidium, you can browse available loan requests and choose which Runes you’re comfortable lending against. Each listing includes a borrower’s proposed interest rate, duration, and collateral details.

The best part? Your return is in BTC.

While DeFi on other chains pays out in unstable altcoins or tokens with inflationary models, Liquidium lets you earn the hardest money out there—no wrapped assets or cross-chain risk.

And since these are peer-to-peer loans, you decide your level of risk and reward.

Unlocking Bitcoin DeFi, One Rune at a Time

Liquidium isn’t just another DeFi app—it’s building native Bitcoin utility.

By creating a lending market for Runes, it gives Bitcoin users real financial tools without needing to move to Ethereum or Solana. It’s all on-chain, secured by Bitcoin, and powered by the growing interest in Ordinals and Runes.

As the Runes ecosystem matures, we’ll likely see more use cases beyond speculation. Lending is one of the first—and Liquidium is paving the way.

Ready to earn real BTC yield on assets that would otherwise sit idle? Head to liquidium.wtf and start exploring the Runes-backed lending marketplace today.